Will rates continue to increase?

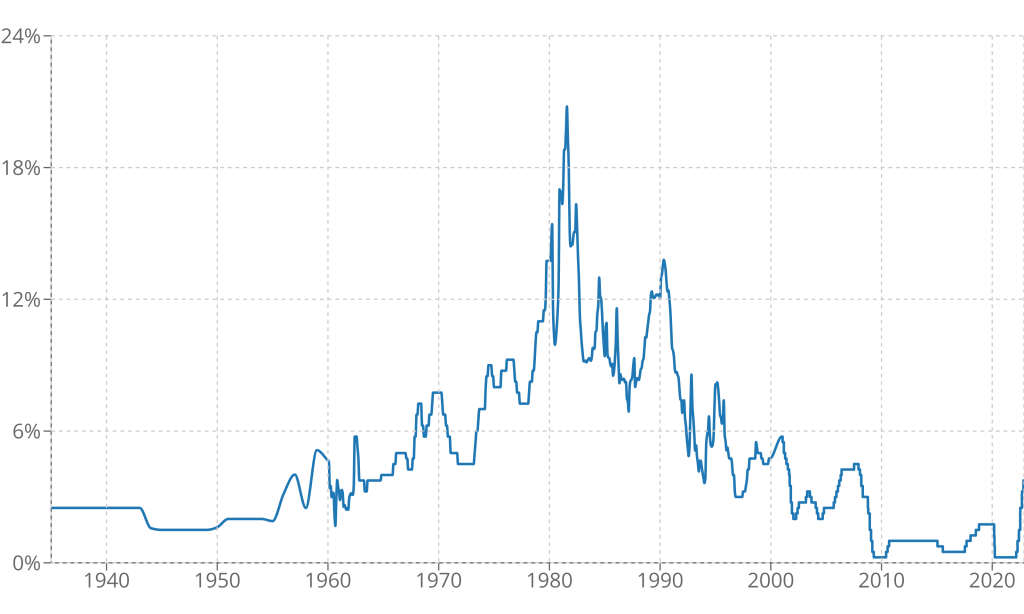

It is not impossible. However, it would be surprising because household debt is very high, and further interest rate increases could cause major defaults across the country. This is not what the banks want. Instead, in the long run, we think we will see a decline and then a stabilization of the market.

Will rates go back down as low as they were before?

No, I don’t think we’re going to see as drastic a drop as we saw during the pandemic between 2020 and 2021. However, we do believe that the days of ultra-low mortgage rates will certainly return in the medium to long term. We just have to be patient and keep an eye out for changes in the market.

How do I find the lowest mortgage rate?

In our opinion, you shouldn’t just sign the rate that your bank offers you, without taking the time to shop around. It’s a huge mistake, and that’s how the banks make their biggest profits. It’s important to compare lenders, even the smaller, lesser known ones, because that’s where you can find lower rates and save money.

What is the best advice you can give?

Never borrow at the limit of your borrowing capacity. For example, if you are assessed to be eligible to borrow $500,000, try to target a budget lower than that limit. This way, if rates go up, you will have some wiggle room that will save you from serious financial worries.