ONLINE MORTGAGE LOAN COMPARATOR COMPARE 20+ BANKS IN 2 MINS ONLY A SIMPLE ONLINE FORM TO FILL OUT FREE AND WITHOUT OBLIGATION

COMPARE 20+ FINANCIAL INSTITUTIONS IN 2 MINUTES

WITH ONLY ONE APPLICATION!

Whether it is for a new purchase, a pre-approval or a renewal, a mortgage broker can get you the best loan with the lowest interest rate, according to your needs and criteria.

COMPARE 20+ BANKS IN ONLY ONE STEP FOR YOUR MORTGAGE!

Fill out the form below and a mortgage broker from your area will rapidly contact you to help you find the best possible offer.

By clicking on the button, I accept the Terms and Conditions

Mortgage rate forecast for 2021: headed for a record year!

2020 was certainly not a great year in terms of economic conditions. While economists and pundits expected rates to increase, the COVID-19 pandemic has certainly upended the Bank of Canada’s plans.

In March 2020, the government announced health measures to contain the spread of the COVID-19 virus, leaving hundreds of thousands of Quebecers unemployed.

Banks have agreed to put some loans on hold, and the Bank of Canada announced it was reducing its prime rate to its lowest level of 0.25%.

Mortgage rates tumbled in May and summer 2020 to an all-time low. At the end of the year, rates were very low, creating a favorable scenario for real estate markets across the country.

But what can we expect for 2021? Will the situation continue to stabilize? Will rates go up or can they go down even further?

Find out what experts predict for mortgage rates for the year 2021. Most of these experts agree that we are heading for a record year.

Take advantage of all-time low mortgage rates in 2021

According to many economists and experts in Canada, 2021 will be a continuation of 2020 and will offer an extremely advantageous mortgage landscape for homebuyers as well as owners renewing their mortgages.

In the beginning of 2021, 5-year fixed mortgage interest rates would be at around 1.50%.

In 2018, the average 5-year fixed mortgage rates were around 3.50%, more than double the current supply.

Canadians can expect rates in 2021 to be at an all-time low. Now is the time to take advantage of the best mortgage rates in the country.

Governor of the Bank of Canada announces no interest rate hike until 2023

One of the things that confirm the fact that mortgage rates in 2021 will remain steady is the announcement of no less than the Governor of the Bank of Canada that he would not change the prime rate until the pandemic has subsided.

In late October 2020, Governor Tiff Macklem of the Bank of Canada said the prime rate will not move until 2023.

Interest rates as well as mortgage rates in the market are directly influenced by the prime rate.

For as long as it doesn’t go up, rates stay low. For 2021, it is therefore guaranteed that rates will remain at their current level and at an all-time low.

The change in interest rates depend on the pandemic and economic recovery

What factors will influence interest rates over the next year as well as in 2022 and 2023?

Once again, the Governor of the Bank of Canada explained recently that it is the pandemic and the national economic recovery that will play a role in the decision-making process. The Canadian economy shrank 5.7% in 2020 and will bounce back to 4.2%, according to Tiff Macklem.

It will take several years before the economic situation in Canada stabilizes but not before 2022-2023.

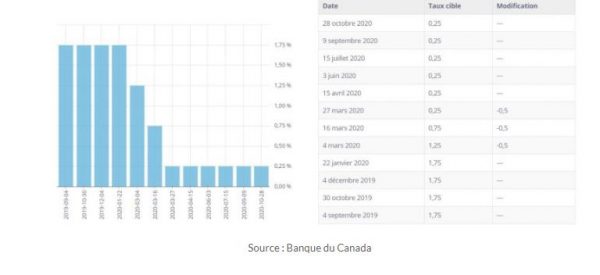

Changes to the prime rate in Canada from 2018-2021

In 2018-2019, the Bank of Canada’s key rate increased to stabilize at 1.75%.

In March 2020, the rate is lowered to 1.25%, then to 0.75% a few days later, then to 0.25% at the end of the month.

In January 2021, the prime will be 0.25% as announced by the Governor of the Bank of Canada.

Rates at the start of the year will therefore still be excellent, which is good news for buyers and homeowners.

There should be no movement and change in the policy rate in 2021.

Recent data on the Prime rate

| Date | Target rate | Change | |

| 28 Oct 2020 | 0.25 | — | |

| 1.75% | 9 Sept 2020 | 0.25 | — |

| 1.50% | 15 July 2020 | 0.25 | — |

| 1.25% | 3 June 2020 | 0.25 | — |

| 1.00% | 15 April 2020 | 0.25 | — |

| 0.75% | 27 March 2020 | 0.25 | -0.5 |

| 0.50% | 16 March 2020 | 0.75 | -0.5 |

| 0.25% | 4 March 2020 | 1.25 | -0.5 |

| 0.00% | 22 Jan 2020 | 1.25 | — |

| 4 Dec 2019 | 1.25 | — | |

| 30 Oct 2019 | 1.25 | — | |

| 4 Sept 2019 | 1.25 | — |

Source: Bank of Canada

Table of mortgage rates in effect at the start of 2021

Now that we know that the rates are unlikely to increase in 2021, what can we expect in terms of mortgage rate offers in the market?

We searched the databases and websites of major financial institutions across the country to create a comparison chart featuring some of the best mortgage offers in early 2021.

Please note that the rates here are indicative only; they are subject to change without notice, and no guarantees are offered. To find actual rates in effect at this time, speak with one of our mortgage partners by filling out the short online form below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed rate – 10 years |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* For information only. Subject to change without prior notice. No rate guarantees. Check current rates by filling out our form to speak to a partner broker.

Shop around and get the best rate for 2021 now!

As you can see from the chart above, mortgage rates are really low right now. This means now is the time to shop around and book your rate for 2021.

Did you know that you can reserve and lock-in a mortgage rate for up to 4 months before your plan to buy a house or renew?

In fact, you can obtain a pre-approval up to 120 days before concluding a transaction.

So don’t wait until the last minute to shop. Instead, compare rates with an expert ahead of time and book the best offer available! Here’s how to do it.

Compare mortgage rates from +20 banks with free form

If you want to shop online for the best mortgage rates and products in Quebec, you should speak with a mortgage broker.

Fill out our 100% free form to compare the rates and products of more than 20 banks with just one form!

Our partners, reliable and experienced mortgage brokers, have exclusive access to the best mortgage rates, ensuring you get the best rate on the market!

Get tips for saving on your mortgage and find the best mortgage rate in 2021 with a mortgage broker from our network!

Speak with one of our partners now to reserve your rate for 2021 by filling out the form below.

It will only take 2 minutes!

COMPARE 20+ BANKS IN ONLY ONE STEP FOR YOUR MORTGAGE!

Fill out the form below and a mortgage broker from your area will rapidly contact you to help you find the best possible offer.

By clicking on the button, I accept the Terms and Conditions

MORTGAGE TYPES

- Conventional mortgage

- Closed Mortgage

- Open Mortgage

- Collateral Mortgage

- Pre-approval

- Mortgage Refinancing

- Mortgage Renewal

- Mortgage Insurance

MORTGAGE BROKERS

Best Mortgage

Quote

BEST MORTGAGE QUOTE is not a mortgage broker or a financial institution. It is a web platform that connects users in need of a mortgage loan with professional mortgage brokers.